A new report from Kardex Remstar features responses from more than 200 warehouse and distribution center professionals across a variety of industries. It provides detailed insights into and what lies ahead for 2024. The persistent labour shortage, ongoing supply chain interruptions, rising freight costs and the fear of running out of physical space will remain as top issues in the order fulfilment and distribution operations space in 2024. Organizations are also worried about meeting their customers’ demand for faster delivery times, how to effectively process returns and data visibility across multiple locations. Let’s dig into the details!

As labour, materials and shipping costs continue to put pressure on companies’ bottom lines in 2024, more warehouses continue to turn to technology, automation and robotics to streamline their order fulfilment processes, reduce costs and compete more effectively. They’re also making better use of vertical space and using space-saving equipment like automated storage and retrieval (AS/RS) systems to improve efficiency and further reduce costs.

As labour, materials and shipping costs continue to put pressure on companies’ bottom lines in 2024, more warehouses continue to turn to technology, automation and robotics to streamline their order fulfilment processes, reduce costs and compete more effectively. They’re also making better use of vertical space and using space-saving equipment like automated storage and retrieval (AS/RS) systems to improve efficiency and further reduce costs.

Top goals for 2024

As companies look into the horizon of 2024, key objectives align with bolstering overall operational efficiency. A notable percentage are prioritising error reduction and enhanced order accuracy, while an equivalent percentage seeks higher productivity levels. Companies aim to tackle their space utilisation challenges and target improvement in picking and handling processes.

Core goals for the upcoming year extend to increased profitability, decreased costs per order, real-time inventory visibility throughout the supply chain, streamlined order fulfilment cycle times, and upgrades in order-picking technology. This collective focus reflects the industry’s commitment to achieving both financial gains and operational excellence.

Expected challenges

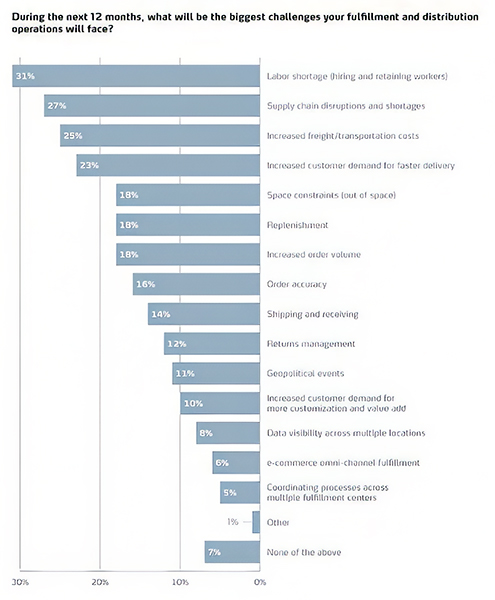

To no one’s surprise, labour reigns supreme at the top of order fulfilment and distribution center managers’ hit lists. It’s also no surprise to see supply chain and freight costs continue to keep them up at night as well while the world recovers from the lingering aftershocks of the COVID-19 disruptions. As if that wasn’t enough, customer demand for faster delivery continues to trend upwards as more consumers’ e-commerce delivery time expectations continue to balloon and the ‘big fish’ drive delivery times down.

The challenges don’t end there. Companies also expect to deal with replenishment issues, higher order volumes, the need for better order accuracy and ongoing returns management pain points. For at least one respondent, convincing corporate that we need to move into the 21st Century in warehousing will present the biggest roadblock over the next 12 months.

Comparing these results with the current challenges that warehouse and DC operators are dealing with—hiring and retaining workers; supply chain disruptions and shortages; higher freight and transportation costs and increased customer demand for faster delivery—it’s clear that companies expect many of 2023’s top challenges to roll over into 2024.

So, what’s the Plan?

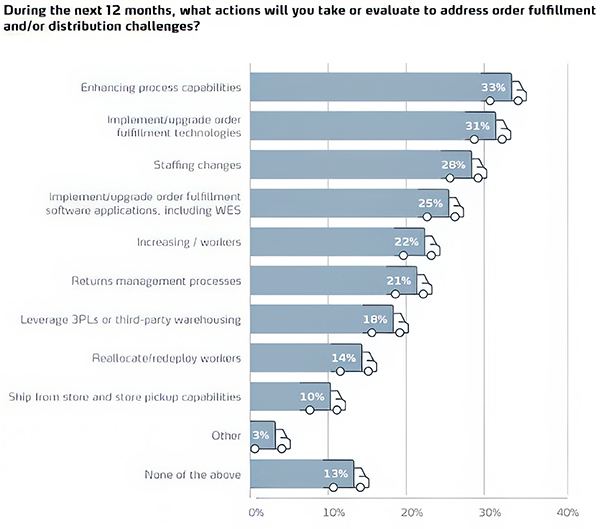

Moving into 2024, companies will tackle their order fulfilment and distribution challenges by enhancing their process capabilities, implementing or upgrading order fulfilment technologies, make staffing changes, or implementing/upgrading their order fulfilment software.

To deal with the new order fulfilment and distribution realities, companies also plan to hire more employees, improve their returns management processes, work with more third-party providers, redeploy workers to different jobs or improve their ship from store and store pickup capabilities.

Technology and automation will continue to play an increasingly important role in the modern order fulfilment or distribution environment.

Specifically, organisations plan to implement WMS/WES/WCS software (18%), radio frequency picking technology (17%), conveyor and sortation systems (15%), robotic cube storage (12%), AMRs (12%) and AGVs (11%), and ASRS including vertical lift modules, vertical carousels, and vertical buffer modules (9%). Companies also plan to evaluate and implement more mini-load/unit-load systems and pick-to-light technology.

Specifically, organisations plan to implement WMS/WES/WCS software (18%), radio frequency picking technology (17%), conveyor and sortation systems (15%), robotic cube storage (12%), AMRs (12%) and AGVs (11%), and ASRS including vertical lift modules, vertical carousels, and vertical buffer modules (9%). Companies also plan to evaluate and implement more mini-load/unit-load systems and pick-to-light technology.

According to the survey, 40% of companies plan to further invest in additional automation systems and technologies or add to their existing systems during the coming year.

As companies find ways to meet current demands while also future proofing their fulfilment operations, they’re increasingly looking for ways to incorporate automation into their warehouses and DCs. Focused on streamlining processes, improving labour utilisation, increasing throughput and improving customer satisfaction levels, organisations that make this move now versus later will be best positioned for success in 2024 and beyond.

To read the full report, click here to learn more about Kardex.